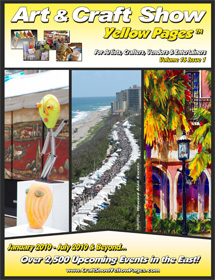

Craft Show

Yellow Pages

©

Toll Free:

(800) 871-2341

Tel: (562) 869-5882

Fax: (562) 904-0546

Office Hours:

M-F 10am-8pm EST

How do you know if you're

~ Making a Profit? ~

Information for Craftsmen & Artists, & Home-based Business Owners

You don't have to be a corporate executive to be familiar with business terms and concepts. Since you are the business owner, you'd better learn to dance double-time to the same tunes as corporate America, to make sure you are making a profit, - and if you are not, - why!

Talking the Talk

Profit: Lets define this term carefully, since so many people misuse it. Before we discuss profit lets look at a few other concepts, -and work our way towards our elusive goal.

Gross sales: If you pay $100 for a show, and you sell $1,000 worth of product, - in my book you have just had an excellent show, (ten times the show fee.) For most hand-crafted products, shows that yield ten times the space fee are becoming rarer than one-eyed jacks. Gross sales was in this case, $1000.00.

Net sales: If you have returns, that money is deducted from your gross sales. From $1000 in gross sales, deduct $100 in returns, your net sales figure is $900.

Business expenses: These are expenses that occur as part of your business. These include mileage/and or actual car expenses, show fees, postage, licenses, insurance, cost of supplies, tools and equipment, office supplies, copying/printing costs, stationery, electric, phone bills, labor costs, dues for professional organizations, etc.

Equipment vs. Supplies: There's a difference between equipment and supplies.

We cover the following Eastern US States:

![]()

*If

you

would like to mail your credit card information, or to send a check,

click

here for an order form to print out. Then fax or mail it in.)

Equipment usually refers to capital assets such as furniture or expensive tools, (sewing machine, serger, kiln, computer, acetylene torch, radial arm saw, etc. ) Capital assets can be expensed -that is taken as an expense all in one year (up to a limit of $18,500 of the cost, for assets put into service in 1998*; it should be a bit higher for tax year 1999. Capital assets can also be depreciated , depending on the type of asset, on a 5, 7 or 10 year depreciation table.* My philosophy is "Expense it and take the deduction up front before they change the tax rules" but it depends on your circumstances. This is a question for your tax advisor, when he looks at the whole picture of this year's income and expenses and your projection of the coming year's income and expenses.

Supplies: The easiest way to think about supplies is that they get used up over a period of time. You buy supplies: 3 bolts of fabric, $100 of postage, a box of envelopes, 25 pcs. of 8 gauge silver wire or a box of nails. As you create product or take care of business (mailing checks, writing letters, etc.) these get used up. Supplies are expensed (taken as an expense in the year in which they are purchased.)

Overhead: This includes ongoing business-related expenses, such as insurance, phone bills, utilities, advertising, rent (if applicable) etc. This is an important cost of doing business, and needs to be factored into your profit formula. The easiest way to do this may be to break down a year's worth of these expenses into a monthly number, and allocate a portion of this amount to each show.

Insurance and phone bills roll on whether or not you have a show or other income that month. These are ongoing expenses. If you do only six shows a year, your overhead may be two months' expenses per show, plus your show fees, etc.

Labor : If you're a one-man business, you have no labor costs, right? (Wrong!)

You have no tax-deductible labor costs, but your time is worth money and must be factored in, even if the IRS won't let you deduct it as an expense. What that means is: your cost of product (goods) sold must include an hourly wage for your time, - somewhere, -somehow. (After all, if you were working for MacDonald's or IBM, you would be paid for your time, - - right?) As business-owner, your paycheck is what is left over at the end of the year.

Gross profit is computed from sales, less returns, less expenses, less overhead (see above). What is left is payment for your labor, and is taxed as income. When you factor in your labor, what is left after paying yourself an hourly wage, (if anything) is your net profit. That's the bottom line: was it worth working all those hours? What's your time worth? After getting paid for your time, if there's anything left over, you can truly call it 'profit.'

Look at it this way: if your net is $10,000, you need to know how many hours you spent in production, setup, breakdown, design time, purchasing, marketing, etc. - or you will never know your hourly wage. If you think you're worth $15 an hour, and you've turned $22 an hour, you have a real profit of $7 an hour because you could have gotten $15 an hour working for someone else.) If you come up with $3 an hour,- this is not profit: this is slavery.

Walking the Walk

Now that you know how to talk the talk, let's see how you walk the walk. As they say in the ads: The job ain't done until the paperwork is finished. That's the walk.

Paperwork is the most despised part of business, but it's the most important, especially to you, AKA: the micro-business owner. There's little room for mistakes when you have to take money out of your business to live, or when an unexpected charge-back on your merchant credit causes your checks to bounce. Micro-businesses are notorious for being under-capitalized and for cash-flow problems, (negative cash-flow, e.g. in the Spring you put out money for shows, but don't have much income.)

Without indicators you won't know if you're losing money or making it, - - whether a product design is a money-maker or costs you money to produce. You may have a few good designs that bring in enough cash flow to cover up a loser. Get rid of the loser and your profits will soar.

Consider: if you spend three hours making a $30 thingee, and use $8 worth of materials, you are losing money, because your cost is $8, plus three hours worth of labor, (?) and a portion of the show fees and your other overhead, leaving not-very-much-money-per-hour. If you haven't been tracking your production, you may not even know that design took three hours to produce.

Profit is what's left over after you pay your bills, and pay your wages. What's left is your profit. If your prices are too low, or if you have a few money-losers in your designs, your profits may be low or non-existent, even if you have money in hand.

Tracking Costs

Track your time in each process; set up a calendar in your workspace and write down start and end-times for daily production; track your time on the road as well as mileage** . The numbers you find as you do this are your' indicators' . It's like drawing a road map. Don't you want to know where you're headed?

If your hourly wage doesn't add up, trim the fat from your processes and find a way of working faster and cheaper. Change your design, your product or your purchasing habits: if you don't buy your materials wholesale, you can't make a profit. As Barbara Brabec says: "Anyone can make money, it's hard to make a profit."

Price structure: How do you price your product, by guess and by gosh? Beginners usually underprice their product. Based on a time-and-materials study, are you selling your product too cheaply?

I've heard lots of rules-of-thumb formulas for pricing, but they won't work for everyone, so what good are they? The only good formula is one which will work across the board, - and will work for almost everyone. Which would you choose from these lame formulas: . Price equals: twice the cost of materials, - four times the cost of materials, ten times the cost of materials, etc.. (Where's the cost of labor? What's the profit?)

A silversmith can take $2 in sheet silver, and 50 cents in silver wire, and spend 2 hours on a piece. Using the formulas above, should he sell it for $5? $10? $25? How about $40 or more, depending on his overhead?

Figure time, materials, overhead, and 10-15% additional to allow for a profit. You will never know if you are making a profit if you don't walk the walk.

So saith ElJay the Web-Dancing Frog. (In your heart you know he's right.)

*J.K. Lasser. s Your Income Tax 2004,

** Mileage is tax deductible, - but you have to document it! Where did you go? How far did you travel? For what purpose? etc.

|

New England & Northeast

Art & Craft Shows, Fairs

[FORMS for Show Promoters]

[Resources:

Sources, links]

[Our Team] [SUBSCRIPTION INFORMATION] - [Email] - [Home] |

Free 7 Day Trial to Craft Show Yellow Pages or Craftmaster News!

Art & Craft Show Yellow Pages is your #1 Reliable source providing detailed information about Art and Craft Shows, Fairs and Festival. The Online Show Listing System for Crafters, Artist, Vendors and Event Promoters.

When you subscribe to Art & Craft Show Yellow Pages not only will you get 24/7 online access to our unique copyrighted data, but you can also request at any time a printed copy for an additional $15.00 dollars each print (Includes Priority S & H) as long as your subscription is current.

Your one year subscription (1 yr) includes instant access to our online system and as a current member you can benefit from Print-on-Demand, our exclusive member service that allows members to request printed copies of the most current events for an additional $15.00 dollars each print (Includes Priority S & H)

-

Rent your booth today! Get contact information to each show NOW!

-

Get Detail information about each show easy and fast with our copywriting quick code format.

-

Google Geo Coded Radius Zip code search

-

Show Reviews & Comments by Exhibitors

-

Easy-to-Read Listings & Reviews

(with our copyrighted data arrangement & organization) -

Read your show listings on the GO! Optional Print-on-demand book!

-

Save on printing costs by using Art and Craft Show Yellow Pages

-

The Most Complete, Accurate, & Up-To-Date Show Listings, Guaranteed!

| Buy Now! Subscribe only 48.95yr |

|

Call us toll free at:

(800) 871-2341

We list detailed information about the following events:

•Art and Craft Shows

•Fine Art and Fine Craft Shows

•Street

Fairs and Festivals

•County

& State Fairs

•Home

& Garden Shows

•Farmer's

Markets

•Antique & Collectible Shows

•Music Festivals

•Car Shows

•Holiday & Gift Shows

...and much more.

Art & Craft Show

Yellow Pages ™ is now Online for

only $48.95 a year! Faster and easier to find more events, Printed

On-Demand for current subscribers only at $15.00 Each Print (Includes

Priority S & H).

Click Here to Browse Our Online Database of Events

for Sample Event Listings - Now

Nationwide!

Sell your arts and crafts at Fairs & Festivals. Find out where the

shows are and start selling at local, state and nationwide events. Sell

at farmers markets, sell your art at street fairs, sell food at

festivals, sell clothing at craft shows, sell jewelry at street fairs

and more.

We list all events Nationwide! We include detail verified information for each event! This is the best source for event information and is ideal for vendors looking to sell their products or services whether you are selling food, promotional items, clothing, antiques, jewelry or any items ranging from hand made to buy and sell.

Subscribe

NOW and get instant access to the most reliable event listing information you can count on!

Art & Craft Show Yellow

Pages is a regional show guide for

craftsmen artists, food vendors and resellers in

Alabama,

Arkansas,

Connecticut,

Washington DC,

Delaware,

Florida,

Georgia,

Iowa,

Illinois,

Indiana,

Kentucky,

Louisiana,

Massachusetts,

Maryland,

Maine,

Michigan,

Minnesota,

Missouri,

Mississippi,

North Carolina,

New Hampshire,

New Jersey,

New York,

Ohio,

Pennsylvania,

Rhode Island,

South Carolina,

Tennessee,

Virginia,

Vermont,

Wisconsin

and

West Virginia

!

Art & craft show listings contain in-depth details and information to help you choose the right shows to sell your arts and crafts, promotional items, food vending, trade or wholesale.

All shows are not

equal.

Choose your shows by targeting your

customer. Will your customer be there?

We even publish information such as:

3 stages of live music, pony

rides, Antique and Classic Car Shows,. . .

- more!

Real show listings with detail descriptions like, event attendance, cost of booth, size of booth, what you can sell at each event or signup deadlines to event. Choose from detailed listings according to your preferences; we let you know if a show is indoors, outdoors, in tents, or in a mall. We even publish eligibility requirements, - so you will know if a show is an 'Open Show' a 'Juried Show' or trade or wholesale shows. If a show is predominantly Contemporary, Traditional, or Country , we print that information too, to help you find the right venues to sell your work.

ART and CRAFT SHOW YELLOW PAGES is the most important tool in your business kit! Subscribe with confidence! We guarantee it will help you with your business, or we'll refund the balance of your subscription!

See: www.craftshowlist.com, www.craftsfairguide.com, www.craftmasternews.com, www.artsCraftsShowBusiness.com, http://www.1nbcard.com/artisan.html

|

List your Art & Craft Shows, Fairs, Festivals, Street Fairs, Garden Shows, Trade & Wholesale shows - |