Craft Show

Yellow Pages

©

Toll Free:

(800) 871-2341

Tel: (562) 869-5882

Fax: (562) 904-0546

Office Hours:

M-F 10am-8pm EST

|

~ Tax Game Plan ~for a Home-Based BusinessAn Upbeat Look at the Tax Advantages of a Home-Based Business by ElJay, the World's First Web-Dancing Frog, Ph.d., M.S., B.S., X,Y & Z!"Any one may so arrange his affairs that his taxes shall be as low as possible; he is not bound to choose that pattern which will best pay the Treasury; there is not even a patriotic duty to increase one's taxes .." Supreme Court Justice Learned Hand .. . . It's not exactly fun living with home and business under one roof. Sometimes the living room looks the packing room at the Sears warehouse. But just in case you didn't know it, there are big-time tax advantages to owning your own business, - yes indeed. Qualifying equipment bought and placed in service in 2002, may be expensed up to $24,000. This means you can 'expense' your new computer, radial arm saw, and other business use equipment up to $24,000 in the first year, instead of depreciating it. Back when cars were depreciated on a three-year basis, our little truck did double duty on two family businesses. We had another vehicle for pleasure, so we were able to depreciate the whole value of the truck over three-years. The depreciation time period is now different, six years, but it’s the same idea. Even if we use the truck for personal use, too, we still can depreciate the percentage which is used for business. If we choose to depreciate a truck or a car, we can also deduct the actual out-of-pocket expenses, such as gas, oil, maintenance, repairs, insurance, tolls, registration, etc. Another option, instead of deducting car expenses and depreciation, would be to use the flat-rate mileage allowance, (which was 36.5 cents per mile for tax year 2002.) The choice of using the allowance or depreciation should be made in the first year you place your vehicle in service for business travel. If you do not use the allowance in the first year, you may not use the allowance for that car in any other year.* Supposing I drive 15,000 miles this year, of which 12,000 was for business? The percentage of business use is 80%, (12,000 divided by 15,000 = 80%.) My actual car expenses (gas, insurance, oil, repairs, etc.) were $1,000, of which $800 (80%) is deductible. If I had a car loan, 80% of the interest would also be deductible. That’s awesome. (Whether we take split-use depreciation, or the flat-rate mileage allowance plus expenses, -documentation of my actual mileage and the dates and purpose of each trip is mandatory.) I like this game; I can make the rules work for me. Let's see: what else can be depreciated? Do I need a computer? Tools? A copier? A new kiln? Better yet, - the law says I can expense them. That means we can write the cost of this equipment off in one year instead of depreciating it over a period of six years. Theoretically, we could even expense the car, depending on the price. Look up the guidelines for the current year. Take Your Tax Deduction NOW Our motto: Never put off until tomorrow the tax deduction we can take today. Who knows? They may change the rules again, and we could lose it. Last year, tax year, we were allowed to expense up to $18,000, all in one year! That means that if we didn't earn that much money, we could deduct up to $18,000 worth of capital equipment expenses and end up with a loss. Since we have other income, under certain conditions, losses from my business can be deducted from that income. September or October is the time to compute your income to see if you should buy new equipment immediately, or defer purchases until next year. Get your paperwork together and see your tax advisor. You could spread out depreciation over a five year period to balance the possibility of increased income as your business grows, …but what do you do with a car, (copier, computer, etc.) after it is totally depreciated? Why you turn it over to family use instead of selling it and owing Uncle Sam salvage value against the depreciation you took. Is it legal? You bet.

We cover the following Eastern US States:

What else? Let's see: -the telephone. That's always good for laughs. Struggling with the phone bill every month to allocate business long distance calls is a pain. A second line makes sense under certain conditions: if you make lots of long distance business calls, or if business and personal calls are interfering with each other, get a separate line for your business;it's a business expense and is tax-deductible. With a business phone, you have a free listing in the Yellow Pages. This is a form of advertising. It gives you visibility and helps your business grow. The least expensive way to have two lines may be to have basic service for one line, and unlimited local dialing for the other. Then you may deduct not only the long-distance calls, but the monthly base rate of the business line, (ours is over $30). If you call Ma Bell and ask questions about the different types of residential contracts, and also costs for business lines, you'll know if the expense can be justified in your particular case. Other benefits: you'll always have a free line, - and if you have a computer, you'll have a line to hook up to the modem and fax machine, and another line for voice calls. Under most conditions, depreciating a portion of your home for business use is not a good idea, but if you have 7 rooms, and use one for business only, you may deduct 1/7th of your heat, garbage removal, mortgage interest, insurance, electric, etc. If the 7th room which you use only for business, is very large, and makes up 35% of the square footage of your house, -why it's to your advantage to deduct 35% of your household expenses, based on the square footage, instead of 1/7th of your expenses as in the previous example.

Your Microbusiness: Is it a Hobby or a Business?What's the Difference? As long as you are presumed to be operating with a profit motive, it's a business.* The law presumes that you are in an activity for profit if you can show a profit three years out of five. With a hobby, when expenses exceed income, expenses are deductible only up to the amount of your income, and the rest is disallowed if they would make a loss. If you have other income, such as another job, or if your spouse has income, losses from your micro-businesses may be deductible against that second income! In an audit, to be considered a business you must be able to prove that you were trying to make a profit by spending considerable time in the activity, by keeping business-like records, relying on expert advice, advertising, etc. Your business cards and lists of upcoming shows that you have on your display as 'pick-ups' are a form of advertising, - as is your yellow-page listing, which is usually free when you have a business telephone line. Even if you have a loss in more than three years out of five, if you can prove a profit motive, your loss will be allowed. Do Your Own Taxes?My spouse is an accountant with years of tax experience, but it’s many years since he made a point of keeping up with all the changes in tax law . I've taken H & R Block Tax Awareness courses through the years to maintain my real-estate license. These courses are only an overview, although very complete for that purpose. We have someone else do our taxes . Getting the information on the right form is only half the battle : as soon as you learn the game, the IRS changes the rules. We have too many other things to do than spend time trying to keep up with their games . We do a quick-total of income and expenses before the end of the year and save tax dollars by shifting income or expenses from this year to the next, or vice-versa. As one of the greatest jurists of all time, Judge Learned Hand said : "Any one may so arrange his affairs that his taxes shall be as low as possible; he is not bound to choose that pattern which will best pay the Treasury; there is not even a patriotic duty to increase one's taxes." So, it is all a game: income, expenses, depreciation, and deductions. Play according to the rules, and have a professional explain the plays; create a strategy and you’ll come out ahead. When you pay a professional to do your taxes, it’s a tax-deductible expense, and he’ll probably save you more money than his fee costs. There

are tax advantages to having a business, -expecially if you take time

to learn the rules. (Wanna’

play?) *Recommended: (tax deductible, of course) J. K. Lasser's Your Income Tax2010 and beyond." **Even if it's a hobby, you must have a sales tax certificate and collect sales tax if you live in a state where this is the law, (e.g. New York, Connecticut, New Jersey, etc.) |

|

|

|

Free 7 Day Trial to Craft Show Yellow Pages or Craftmaster News!

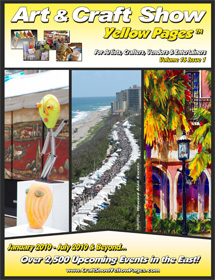

Art & Craft Show Yellow Pages is your #1 Reliable source providing detailed information about Art and Craft Shows, Fairs and Festival. The Online Show Listing System for Crafters, Artist, Vendors and Event Promoters.

When you subscribe to Art & Craft Show Yellow Pages not only will you get 24/7 online access to our unique copyrighted data, but you can also request at any time a printed copy for an additional $15.00 dollars each print (Includes Priority S & H) as long as your subscription is current.

Your one year subscription (1 yr) includes instant access to our online system and as a current member you can benefit from Print-on-Demand, our exclusive member service that allows members to request printed copies of the most current events for an additional $15.00 dollars each print (Includes Priority S & H)

-

Rent your booth today! Get contact information to each show NOW!

-

Get Detail information about each show easy and fast with our copywriting quick code format.

-

Google Geo Coded Radius Zip code search

-

Show Reviews & Comments by Exhibitors

-

Easy-to-Read Listings & Reviews

(with our copyrighted data arrangement & organization) -

Read your show listings on the GO! Optional Print-on-demand book!

-

Save on printing costs by using Art and Craft Show Yellow Pages

-

The Most Complete, Accurate, & Up-To-Date Show Listings, Guaranteed!

| Buy Now! Subscribe only 48.95yr |

|

Call us toll free at:

(800) 871-2341

We list detailed information about the following events:

•Art and Craft Shows

•Fine Art and Fine Craft Shows

•Street

Fairs and Festivals

•County

& State Fairs

•Home

& Garden Shows

•Farmer's

Markets

•Antique & Collectible Shows

•Music Festivals

•Car Shows

•Holiday & Gift Shows

...and much more.

Art & Craft Show

Yellow Pages ™ is now Online for

only $48.95 a year! Faster and easier to find more events, Printed

On-Demand for current subscribers only at $15.00 Each Print (Includes

Priority S & H).

Click Here to Browse Our Online Database of Events

for Sample Event Listings - Now

Nationwide!

Sell your arts and crafts at Fairs & Festivals. Find out where the

shows are and start selling at local, state and nationwide events. Sell

at farmers markets, sell your art at street fairs, sell food at

festivals, sell clothing at craft shows, sell jewelry at street fairs

and more.

We list all events Nationwide! We include detail verified information for each event! This is the best source for event information and is ideal for vendors looking to sell their products or services whether you are selling food, promotional items, clothing, antiques, jewelry or any items ranging from hand made to buy and sell.

Subscribe

NOW and get instant access to the most reliable event listing information you can count on!

Art & Craft Show Yellow

Pages is a regional show guide for

craftsmen artists, food vendors and resellers in

Alabama,

Arkansas,

Connecticut,

Washington DC,

Delaware,

Florida,

Georgia,

Iowa,

Illinois,

Indiana,

Kentucky,

Louisiana,

Massachusetts,

Maryland,

Maine,

Michigan,

Minnesota,

Missouri,

Mississippi,

North Carolina,

New Hampshire,

New Jersey,

New York,

Ohio,

Pennsylvania,

Rhode Island,

South Carolina,

Tennessee,

Virginia,

Vermont,

Wisconsin

and

West Virginia

!

Art & craft show listings contain in-depth details and information to help you choose the right shows to sell your arts and crafts, promotional items, food vending, trade or wholesale.

All shows are not

equal.

Choose your shows by targeting your

customer. Will your customer be there?

We even publish information such as:

3 stages of live music, pony

rides, Antique and Classic Car Shows,. . .

- more!

Real show listings with detail descriptions like, event attendance, cost of booth, size of booth, what you can sell at each event or signup deadlines to event. Choose from detailed listings according to your preferences; we let you know if a show is indoors, outdoors, in tents, or in a mall. We even publish eligibility requirements, - so you will know if a show is an 'Open Show' a 'Juried Show' or trade or wholesale shows. If a show is predominantly Contemporary, Traditional, or Country , we print that information too, to help you find the right venues to sell your work.

ART and CRAFT SHOW YELLOW PAGES is the most important tool in your business kit! Subscribe with confidence! We guarantee it will help you with your business, or we'll refund the balance of your subscription!

the balance of your unmailed issues!

See: www.craftshowlist.com, www.craftsfairguide.com, www.craftmasternews.com, www.artsCraftsShowBusiness.com, http://www.1nbcard.com/artisan.html

|

List your Art & Craft Shows, Fairs, Festivals, Street Fairs, Garden Shows, Trade & Wholesale shows - |