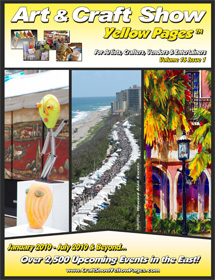

Craft Show

Yellow Pages

©

Toll Free:

(800) 871-2341

Tel: (562) 869-5882

Fax: (562) 904-0546

Office Hours:

M-F 10am-8pm EST

~ Legal Issues ~

Starting Your Business

from past issues of Art & Craft Show Yellow Pages

Subscribe now, and get great articles like this in every issue, - along with very detailed show listings!

These little details may seem overwhelming, but they must be dealt with before you can be in business. Take care of details on this list, one by one. This is the absolute bare-minimum information you must be aware of before you consider yourself "in business."

Zoning laws can be dealt with by keeping a low profile. If your area is not business-friendly, if where you live and plan to work at your craft business is zoned 'residential' either respect that by not trying to open a store-front/studio in your home (just do your production work there, and sell at shows or to shops) - or go for a variance. Respect your local laws .

Zoning. In some areas zoning is business-friendly and you can have a small business in your home. Look up your local zoning laws to find out the restrictions, if any.

In most areas, you cannot run a business in a residential area unless you get a variance, - have the area re-zoned, or keep a low profile and don’t have customers come to your house. (Don’t annoy the neighbors!)

Licenses. New York City and other places require a special license. Check with the show promoter when you will be doing a show in unfamiliar territory. Sometimes the promoter will arrange for the licenses, - sometimes it’s up to you. (Don’t leave this until the last minute—allow 4-6 weeks.)

Doing Business Under an Assumed Name: In New York you need a D/B/A form. Any stationery store that carries legal forms will usually carry a D/B/A form. Basicly it is a deposition that states who you are, where you live, and the business name by which you'd like to be known, e.g. "Mary's Hand-crafted Doll Babies." Register your DBA, (in N.Y.state it should be registered at the County seat) -and make sure you get at least two copies, one of which should be CERTIFIED. The certified copy (you'll pay a few dollars extra to have it certified) will go to your bank when you set up a business checking account. The other copy is for your files. (You can request the bank make a copy of the certified copy, and keep it in case you want to change banks sometime in the future .

A Separate Checking Account: Keep your business and your personal/household monies separate. You will need a business checking account to pay for goods at wholesale prices, - and a copy of your sales tax certificate to show you are entitled to wholesale prices from suppliers who offer them.

When you borrow personal money to pay for your business, write yourself a note in your checkbook that you bollowed $35 (whatever!). This is important information at the end of the year so you can see if you made a profit, (and so you can pay back borrowed funds.)

Sales Tax. Call for a sales tax application at least 8 weeks before you plan to sell your work. If you live in CT, MA, NJ, NY, PA or VT, go tosalestax.html for the contact information of your state's sales tax office.

Make sure you have your Certificate of Taxation with you at shows, and post it in plain view at all times at the show.

Receipts: In New York State you are required to write a receipt for every sale, and to list the sales tax separately. (You may see some exhibitors include the sales tax in their price, - and not giving written receipts. This is illegal in New York.) It's not difficult to write receipts for each purchase; even when you have customers three-deep waiting to buy somethng, you have time to write a receipt.

Make eye contact with each person waiting, smile, and say "I'll be right with you." Write your receipt so you'll know when you look at the carbon duplicates, - exactly how many of each size, color and style you sold. That way you'll see trends as they begin. You'll also know how many replacements to make for the next event.

Income tax: Business or Hobby? Keep records of your sales, and your expenses. Run your business in a ‘business-like’ way; if you have a profit motive, you are entitled to deduct business losses against other income, e.g. advertise (business cards, show schedules, etc.) If you have space to set up your work area in a room, by itself (the room has no other purpose) you can deduct a percentage of your utilities, garbage pickup, insurance, etc. as business expenses. These expenses may be deducted if your work area is dual-purpose, e.g. guest-room/work room beginning 2002.

Intellectual Property: Do not copy ‘Mickey-Mouse’ and friends, or any other copyrighted characters or designs. These are protected by copyright law, as are Raggedy Ann and Andy, certain doll patterns, etc. Look for copyright limitations on material you want to reproduce. Even Dover Books has limitations in the front of some of their design books.

Independent Contractor Status: If you need help with production, avoid trying to assign ‘independent contractor status’ to your helper. Surprisingly, New York State is more aggressive in going after people who claim independent contractor status than is the Federal Government.

The IRS has a 20-point list to help you decide whether you have an employee or have hired an independent contractor. The State does not use the 20-point IRS guidelines—and has not been consistent with its decisions. It has audited 3 out of 5 ‘independent status’ tax returns.

Insurance: If you exhibit at a show, you need liability insurance. In most cases homeowner’s insurance will not cover the customer who slips on your stairs if she came to pick up an order. If you need a source of liability insurance that is designed to cover home-based businesses, follows you to shows, and covers theft of your product from your vehicle, email me: Betty@smartfrogs.com

Forms of Business Ownership: What form will your business take?

a. Will you be a sole proprietor?

As business owner you will have complete control, - and unlimited personal liability. File a d/b/a for your business with state and local government.

Taxes: - Income will be taxed as personal income (Schedule ‘C’) - and subject to self employment tax.

b. Will you enter a Partnership?-A partnership is formed when two or more individuals are in business together. A written agreement is recommended, along with a formal Partnership Agreement registered in your County Seat.) Each partner has unlimited personal liability. Income from partnership is taxed as personal income, pro rata to each partner.

Pro: - help with labor.

Con: - you are liable for debts incurred by your partner. -Decision making can be difficult and often each partner feels taken advantage of by the other..

c. Corporation: Shareholders, Board of Directors. Officers carry out the policies, make decisions, (as defined in the Certificate of Incorporation.)

Personal liability is limited to shareholder’s investment in the corporation. Corporate officers may be liable for withholding taxes.

d. Limited Liability Company (LLC) Since this entity has different qualities in different states, and is fairly new, talk to a C.P.A. or lawyer before you decide on this form of business ownership. It is similar to a corporation in limiting liability.

Taxes are treated like partnerships, and dissolution, sale or merger in N.Y. state necessitates a vote of at least two-thirds of the members.

Does this sound like a lot of trouble? It's not. It's just unfamiliar territory. Owning your own business has many advantages, including tax deductions! See the article: Game Plan for a Home-Based Business for tax-saving information.

Enjoy. Well begun is half-done. Start your business right: legally.

I bet you'd like to have more

great articles like these!

Subscribe to

Art & Craft Show Yellow Pages. . Only

a few of our articles get posted on the internet , -

we publish online great articles and

hundreds of new show listings, show reviews, tips, techniques,

marketing information...more!

Subscribe to

Art & Craft Show Yellow Pages. . Only

a few of our articles get posted on the internet , -

we publish online great articles and

hundreds of new show listings, show reviews, tips, techniques,

marketing information...more!

Click here for more information about Art & Craft Show Yellow Pages.

Free 7 Day Trial to Craft Show Yellow Pages or Craftmaster News!

Art & Craft Show Yellow Pages is your #1 Reliable source providing detailed information about Art and Craft Shows, Fairs and Festival. The Online Show Listing System for Crafters, Artist, Vendors and Event Promoters.

When you subscribe to Art & Craft Show Yellow Pages not only will you get 24/7 online access to our unique copyrighted data, but you can also request at any time a printed copy for an additional $15.00 dollars each print (Includes Priority S & H) as long as your subscription is current.

Your one year subscription (1 yr) includes instant access to our online system and as a current member you can benefit from Print-on-Demand, our exclusive member service that allows members to request printed copies of the most current events for an additional $15.00 dollars each print (Includes Priority S & H)

-

Rent your booth today! Get contact information to each show NOW!

-

Get Detail information about each show easy and fast with our copywriting quick code format.

-

Google Geo Coded Radius Zip code search

-

Show Reviews & Comments by Exhibitors

-

Easy-to-Read Listings & Reviews

(with our copyrighted data arrangement & organization) -

Read your show listings on the GO! Optional Print-on-demand book!

-

Save on printing costs by using Art and Craft Show Yellow Pages

-

The Most Complete, Accurate, & Up-To-Date Show Listings, Guaranteed!

[Our

Team] [SUBSCRIPTION

INFORMATION]

- [Email] -

[Home]

| Buy Now! Subscribe only 48.95yr |

|

Call us toll free at:

(800) 871-2341

We list detailed information about the following events:

•Art and Craft Shows

•Fine Art and Fine Craft Shows

•Street

Fairs and Festivals

•County

& State Fairs

•Home

& Garden Shows

•Farmer's

Markets

•Antique & Collectible Shows

•Music Festivals

•Car Shows

•Holiday & Gift Shows

...and much more.

Art & Craft Show

Yellow Pages ™ is now Online for

only $48.95 a year! Faster and easier to find more events, Printed

On-Demand for current subscribers only at $15.00 Each Print (Includes

Priority S & H).

Click Here to Browse Our Online Database of Events

for Sample Event Listings - Now

Nationwide!

Sell your arts and crafts at Fairs & Festivals. Find out where the

shows are and start selling at local, state and nationwide events. Sell

at farmers markets, sell your art at street fairs, sell food at

festivals, sell clothing at craft shows, sell jewelry at street fairs

and more.

We list all events Nationwide! We include detail verified information for each event! This is the best source for event information and is ideal for vendors looking to sell their products or services whether you are selling food, promotional items, clothing, antiques, jewelry or any items ranging from hand made to buy and sell.

Subscribe

NOW and get instant access to the most reliable event listing information you can count on!

Art & Craft Show Yellow

Pages is a regional show guide for

craftsmen artists, food vendors and resellers in

Alabama,

Arkansas,

Connecticut,

Washington DC,

Delaware,

Florida,

Georgia,

Iowa,

Illinois,

Indiana,

Kentucky,

Louisiana,

Massachusetts,

Maryland,

Maine,

Michigan,

Minnesota,

Missouri,

Mississippi,

North Carolina,

New Hampshire,

New Jersey,

New York,

Ohio,

Pennsylvania,

Rhode Island,

South Carolina,

Tennessee,

Virginia,

Vermont,

Wisconsin

and

West Virginia

!

Art & craft show listings contain in-depth details and information to help you choose the right shows to sell your arts and crafts, promotional items, food vending, trade or wholesale.

All shows are not

equal.

Choose your shows by targeting your

customer. Will your customer be there?

We even publish information such as:

3 stages of live music, pony

rides, Antique and Classic Car Shows,. . .

- more!

Real show listings with detail descriptions like, event attendance, cost of booth, size of booth, what you can sell at each event or signup deadlines to event. Choose from detailed listings according to your preferences; we let you know if a show is indoors, outdoors, in tents, or in a mall. We even publish eligibility requirements, - so you will know if a show is an 'Open Show' a 'Juried Show' or trade or wholesale shows. If a show is predominantly Contemporary, Traditional, or Country , we print that information too, to help you find the right venues to sell your work.

ART and CRAFT SHOW YELLOW PAGES is the most important tool in your business kit! Subscribe with confidence! We guarantee it will help you with your business, or we'll refund the balance of your subscription!

See: www.craftshowlist.com, www.craftsfairguide.com, www.craftmasternews.com, www.artsCraftsShowBusiness.com, http://www.1nbcard.com/artisan.html

|

List your Art & Craft Shows, Fairs, Festivals, Street Fairs, Garden Shows, Trade & Wholesale shows - |